Private & Secure

Track your wealth without linking accounts or sharing logins. Everything stays on your device, safe and under your control.

Holistic view

Get the full picture of your finances in one place. All assets, all currencies, with real-time updates and no spreadsheets.

Own your data

Export, import, or sync your data securely across devices anytime. No lock-in, no hidden barriers - your data always belongs to you.

Your entire financial world, in your pocket

Simple enough for your first investment, powerful enough for your entire portfolio

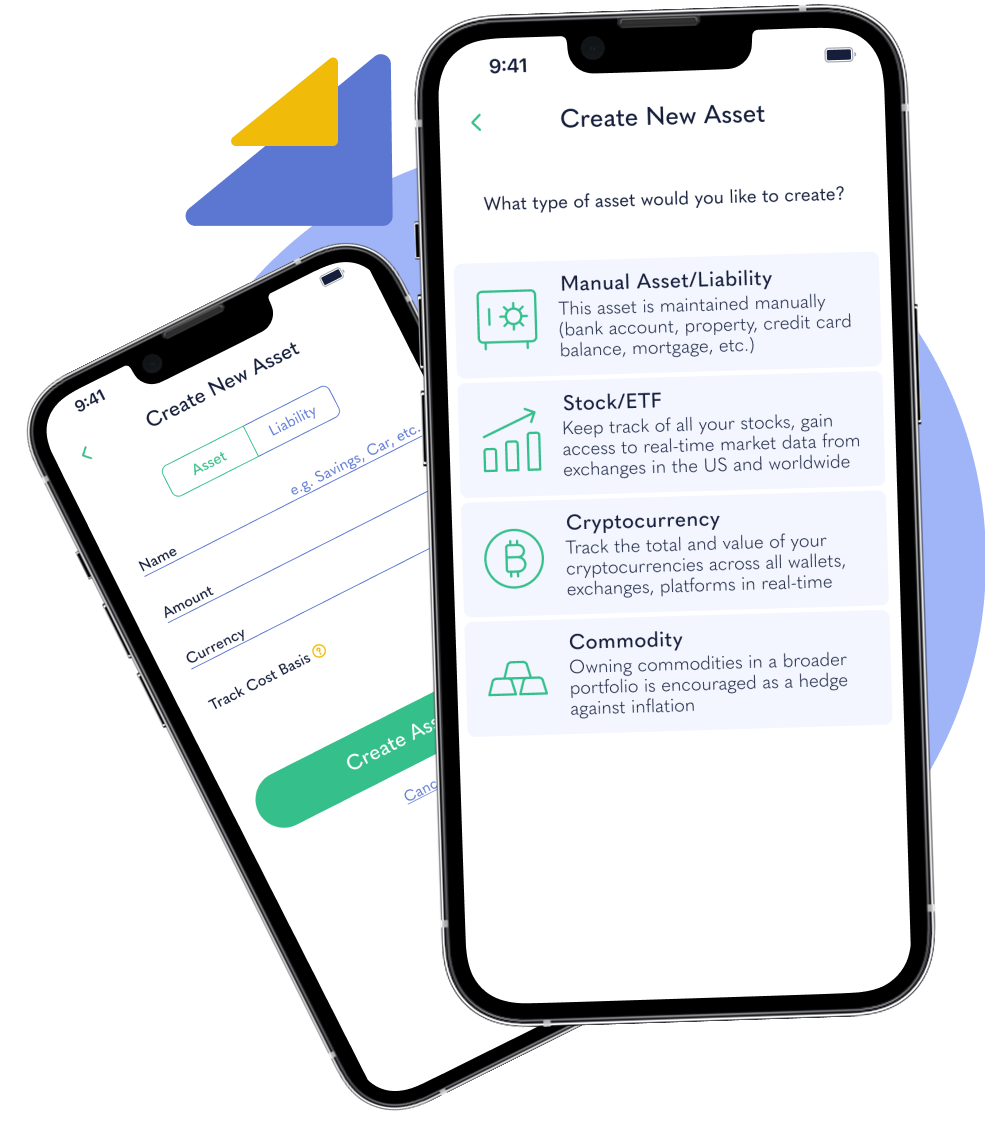

One place for all your assets

✔ Create unlimited portfolios, assign their own currencies, and see everything converted to your home currency

✔ Cash, cards, loans, real estate, stocks, ETFs, crypto, and more

Always know what you own

✔ See the full picture

✔ Instantly see your total net worth, daily performance, and allocation across asset classes.

✔ Interactive historical charts show your wealth growth over time.

Plan smarter for tomorrow

✔ Real-time intraday prices for stocks, ETFs, and crypto.

✔ Built-in dividend tracker, cost basis, and unrealised P/L.

✔ Retirement age estimator (premium).

See why people love using TrackMyStack

Pricing

We believe pricing should be easy to understand. That’s why we offer only two plans, with no hidden fees or surprises.

Free, forever

Powerful features at no cost-

Unlimited assets/portfolios

-

Eod prices for stocks, crypto, ETFs

-

Historical dividend tracker

-

Import/Export data

-

Face ID/Fingerprint/Pin protection

-

Account syncing

Premium

Solution for advanced users-

Everything in Free, plus:

-

Real Timea Prices

-

Upcoming dividends

-

Retirement age estimator

-

Support an indie team

-

Priority Support